New Tax Breaks: Why Now’s the Time to Invest in Automated Equipment

As the calendar winds down, many business leaders find themselves weighing whether to move forward with equipment purchases or hold off until the new year. Thanks to recent legislation signed into law on July 4, 2025, the decision may be easier than ever. Congress has permanently locked in powerful tax breaks for equipment and factory investments, making this a particularly smart time to act.

(Important note: BPI is not providing tax advice. We encourage you to consult your accountant or tax professional to understand how these provisions apply to your situation.)

How Section 179 Expensing is a Boost for Smaller Purchases

For small and mid-sized businesses, Section 179 remains a reliable tool. It allows you to deduct up to $2.5 million in qualifying equipment purchases per year. Once your total purchases reach $4 million, the benefit begins to phase out and disappears entirely after $6.5 million. The deduction covers most machinery, off-the-shelf software and even some building improvements. The only catch is that the deduction can’t exceed your taxable income, though any unused amounts can carry forward into future years.

This makes Section 179 especially appealing for businesses making targeted investments before year-end. Adding a single piece of automation equipment or upgrading specific areas of your production floor can deliver immediate tax savings from practical purchases.

A Game Changer for Larger Investments with Bonus Depreciation

For companies taking on bigger projects, bonus depreciation has become an even more powerful incentive. Businesses can now immediately write off 100% of the cost of qualifying assets in the year they are placed into service. That includes both new and used equipment, as long as it has a useful life of 20 years or less (think machinery, vehicles or computers). Unlike Section 179, bonus depreciation isn’t tied to your taxable income, so it can create or increase a loss on paper while still delivering a strong cash benefit.

What’s even more significant is that this isn’t a temporary perk. Earlier plans to phase out bonus depreciation have been repealed, making 100% expensing a permanent part of the tax code moving forward.

How They Work Together

In practice, Section 179 applies first, giving small and mid-sized companies flexibility for routine upgrades. Anything beyond those limits then qualifies for bonus depreciation, which has no cap. Together, they create an environment where almost any level of equipment investment can be written off in the first year.

Why This Matters Now

The biggest takeaway for business leaders is simple: year-one write-offs are the new normal. If you’ve been debating whether to upgrade equipment, expand production or invest in automation, acting before year-end will help you capture the maximum benefit for 2025. Smaller targeted buys can deliver savings through Section 179, while larger, high-dollar investments qualify under bonus depreciation without restriction.

Why Work with BPI?

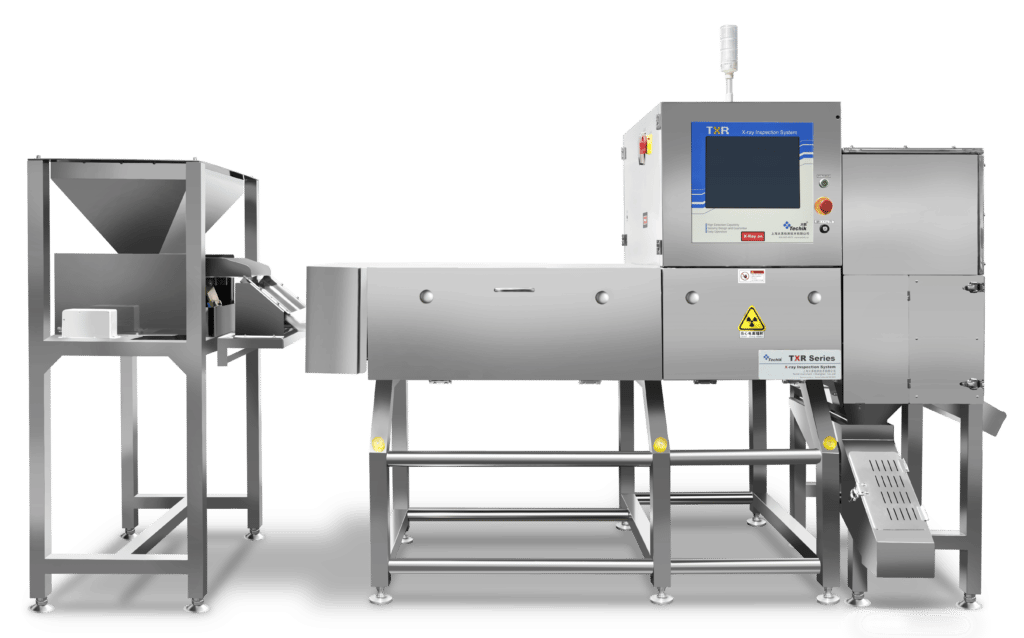

At BPI, we provide packaging automation solutions that fit businesses of all sizes. From specialized machinery like our RDP250 Rotary Pre-Made Pouch Bagger to full-scale automation systems, our suite of equipment qualifies for these new incentives while helping you streamline operations and cut costs long-term.

Take the Next Step

Now is the perfect time to put new equipment to work for your business. Don’t leave potential tax savings on the table.

(Tax laws can change quickly, and states may not always follow federal rules. BPI does not provide financial or tax advice. Please consult your accountant or tax professional for the latest updates and to understand what these incentives mean for your specific situation.)